In a Firm Commitment the Investment Banker

The opposite is a firm commitment or bought deal in which the underwriter buys all shares or debt and has to sell it all to make money. Firm Commitment The underwriter agrees to buy the entire issue and assume full financial responsibility for any unsold shares.

Bnp Paribas Wealth Bnpp Wealth Twitter

The investment banker finds the best marketing arrangement for the investment banking firm.

. B spread between the buying and selling price is less than one percent. When the investment banker buys the securities for less than the offering price and accepts the risk of not being able to sell them. A firm commitment arrangement with an investment banker occurs when _______.

O C finds the best marketing arrangement for the investment-banking firm. A firm commitment arrangement with an investment banker occurs when the. 22 ______ A syndicate is in place to handle the issue.

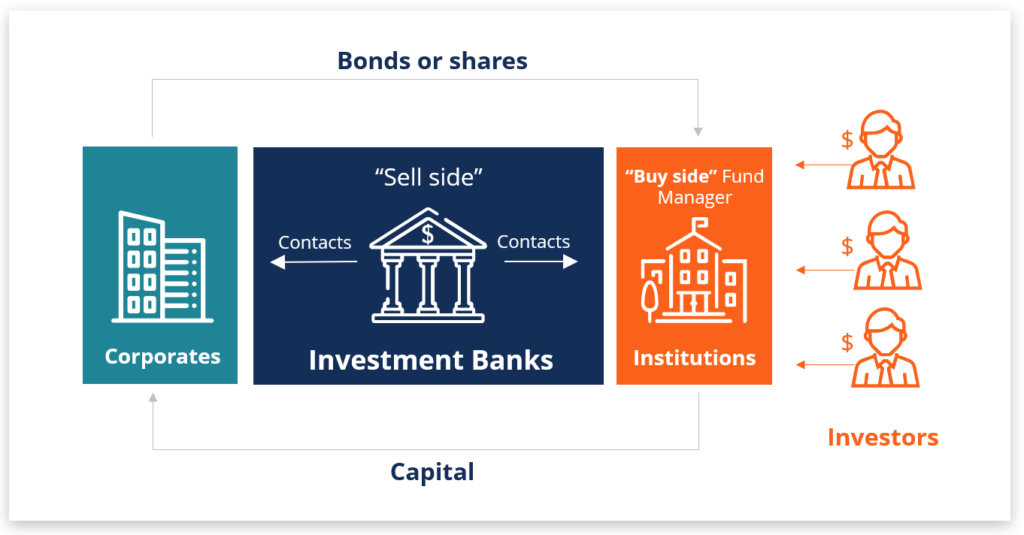

This agreement outlines the banks purchase of the securities from the issue so that these securities can be offered to the public. Firm commitment underwritings are based on formal agreement that the underwriter will take up the whole issue while in best efforts underwritings the underwriter simply promises to exert its best efforts to resell the securities. What We Do Asset Management.

Best efforts the underwriter commits to selling as much of the IPO as possible at the negotiated offering price. The investment banker buys the securities for less than the offering price and accepts the risk of not being able to sell them. A firm commitment arrangement with an investment banker occurs when.

An investment banker who underwrites securities through a firm commitment contract performs Aa brokerage function Ba qualitative asset transformation function Cboth a and b Da funding function Ea loan-originating function. A firm commitment is when a written agreement exists between an investment bank and the issuer of the securities. Previous Fully Reporting Company Investment Banking.

O investment banker sels as much of the securty as the market can beer without a price decrease O issue is solidly sccepted in the market as evidenced by a large price increase O spread between the buying and selling price is less than one percent. With a firm commitment underwriting the investment bank purchases the securities from the company at a negotiated price and sells them to the investing public at. Empirical evidence suggests that new equity issues are generally ______.

When an underwriter enters into a contract with a company to help raise capital there are three main types of commitments made by the investment bank. O B agrees to help the firm sell the stock at a favorable price. Understanding Best Efforts When a company decides to sell.

In a firm commitment underwriting the issuer already knows at the time the registration statement becomes effective how much money it is going to receive from the offering. In a firm commitment. Most reputable investment banks will underwrite an IPO on a firm commitment basis.

D B and C. B the investment banker agrees to help the firm sell the stock at a favorable price. Firm commitment best efforts and all-or-none.

Firm commitment the underwriter agrees to buy the entire IPO and assume full financial responsibility for any unsold shares. 22 A firm commitment arrangement with an investment banker occurs when the. If an IPO is being underwritten on a best efforts basis it should serve as.

When an investment banker purchases an offering froma bond issuer and then resells it to the public this is known as a. C the investment banker finds the best marketing arrangement for the investment banking firm. E A and B.

In firm commitment the investment banker buys the all the securities or shares or debt instrument of the company and sells them to the public. Leaders in Alternative Asset Management and Investment Banking. Best Efforts Underwriter commits to selling as much of the issue as possible at the agreed-upon offering price but can return any unsold shares to the issuer without financial responsibility.

Arcano provides its clients with access to highly specialised and well-diversified investment vehicles focused on alternative assets. In a firm commitment A the investment banker buys the stock from the company and resells the issue to the public. M Spindt P.

The spread between the buying and selling price is less than one percent. In the case of a firm commitment the underwriter agrees to buy the entire issue at a certain price. C issue is solidly accepted in the market as evidenced by a.

Since its inception Arcano has. Underpriced in part to counteract the winners curse. Describe the differences in the underwriting process for an Investment Bank between a firm commitment securities.

Usually firm commitment underwriting is only done for higher quality companies or where the investment bank as obtained indications of interest which reflect that it will be able to resell the shares. The investment banker buys the stock from the company and resells the issue to the public. Investment bankers act as principals ie investors who buy or sell on their own account in firm commitment transactions or act as agents in best effort and standby commitments.

But can return any shares not sold to the company without any financial obligation. The investment banker agrees to help the firm sell the stock at a favorable price. View the full answer.

Academic Research on Best Efforts by Underwriters. Types of Underwriting Commitment. Journal of financial Economics 242 343-361.

In a firm commitment the investment banker OA buys the stock from the company and resells the issue to the public. Benveniste and Spindt examine how investment bankers rely on the signs of interest from their investor clients to price and appropriate new. This industry also includes establishments acting as principals in buying or selling securities generally on a spread basis such as securities dealers or stock.

How investment bankers determine the offer price and allocation of new issues Benveniste L. Firm commitment to sustainability and responsible investment. The investment banker in order to make money.

The syndicate is in place to handle the issue.

Page Manajemen Bank Bjb Bank Bjb

2015 Top Commercial Real Estate Brokerage Firms Commercial Property Executive Cre Commercial Real Estate Commercial Property Commercial

China S March To Capital Markets Euromoney

/GettyImages-694987777-1e928fc96f0544cea96ba24e589f4c88.jpg)

Underwriting Agreement Definition

Bnp Paribas Wealth Bnpp Wealth Twitter

Bu440 Managerial Finance Ii Exam 7 Answers Exam Small Business Development Small Business Development Center

Digital Banking In Asia Pacific Bcg

Pasar Uang Dan Valas Yuk Pelajari Lebih Dalam Keduanya

Solved Which One Is True About The Firm Commitment If A Or Chegg Com

Investment Banking Overview Guide What You Need To Know

Jp Morgan Chase Hack 4 Steps You Must Do Now Jpmorgan Chase Investment Banking Jpmorgan Chase Co

Villa For Sale At El Yasmeen New Cairo Inland Properties Egypt Pool Prices Swimming Pool Prices Villa

Comments

Post a Comment